- Source: The New York Times

- Author: Scott Reyburn

- Date: June 15, 2018

- Format: DIGITAL

Back to Blue-Chip Works

at a More Conservative Art Basel

BASEL, Switzerland — The Art Basel fair is widely regarded as the event that defines the current state of the art market from a dealer’s point of view.

The 290 galleries exhibiting at the 49th edition, which previewed on Tuesday, were hoping the fair would attract the sort of demand for modern and contemporary art that had recently raised $2 billion from a week of auctions in New York.

Art fairs create a very different dynamic from auctions. But within the first hour of the opening, the ground-floor booths of the world’s top dealers were, as usual, crowded with wealthy collectors, eagerly browsing — and sometimes buying — freshly available works by established names. Upstairs on the second floor, where dealers presented more new works by established and emerging artists, the footfall was conspicuously lighter.

“It’s a very good snapshot of the international art scene today, but it does represent a narrow band of practices,” said Melissa Chiu, the globally minded director of the Hirshhorn Museum and Sculpture Garden in Washington D.C., which attracted 475,000 visitors during her “Yayoi Kusama: Infinity Mirrors” show last year. “It’s representative of what’s salable and what collectors are interested in,” added Ms. Chiu.

Increasingly, in today’s polarized and “financialized” art world, those collectors are more interested in safe investment than emerging talent.

This explained, in part, why the Abstract Expressionist painter Joan Mitchell, who died in 1992, was the unlikely star of the fair, which last year drew an attendance of 95,000.

The Abstract Expressionist painter Joan Mitchell, who died in 1992, was the unlikely star of the Art Basel fair in Switzerland. Her 1959 painting “Untitled” was sold by the New York and London dealership Lévy Gorvy at Art Basel. It carried an asking price of $14 million. Credit Estate of Joan Mitchell

Last month in New York, auction prices for the artist reached a new high of $16.6 million. In addition, the powerhouse gallery David Zwirner announced that it had taken over representation of her estate.

Such developments give confidence to investment-minded art buyers — and sellers. There were at least half a dozen paintings by Ms. Mitchell available in the ground-floor “Galleries” section of the fair. For many, the pick of these was a sumptuous abstract on the booth of the New York and London dealers Lévy Gorvy. Painted in Paris in 1959, and notable for its thick impasto with vivid passages of red, this was on consignment from a private collection at an asking price of $14 million. It sold by the end of the first day.

“We had three reserves on this from the beginning,” said Brett Gorvy, co-founder and partner at Lévy Gorvy. “A lot of clients need the confidence of other people’s interest.”

Hauser & Wirth said it found a buyer for the 1969 painting “Composition,” from the artist’s “Sunflower” series, again priced at $14 million, and David Zwirner sold a 1958 abstract priced at $7.5 million.

Top galleries’ ability to enhance the value of artists’ estates was also underlined at the fair by Hauser & Wirth. The gallery has recently taken over representing the estate of the Polish artist Alina Szapocznikow, a Holocaust survivor who made arresting polyester resin sculptures evoking fragments of the human body that she called “awkward objects.” A lamp whose light took the form of a breast was sold by Hauser & Wirth at the fair for $950,000, some $135,000 more than the current auction high for the artist.

“Red Rack of Those Ravaged and Unconsenting,” a 2018 multimedia work by Doreen Garner, was sold by the New York gallery JTT in the Statements section of Art Basel. Credit Courtesy of the Artist and JTT, New York

Ms. Szapocznikow has an uncompromising vision, and so too does the Brooklyn-based artist Doreen Garner, who featured in the fair’s “Statements” section devoted to 12 solo presentations of emerging artists. The New York gallery JTT presented a disturbing 2018 mixed media installation of simulated hanging meat by Ms. Garner inspired by the horrific experiments conducted by the 19th-century gynecologist James Marion Sims on unanesthetized women.

“Red Rack of those Ravaged and Unconsenting,” priced at $40,000, was bought by a European collector on the second day, according to the gallery.

“Entertainment Center,” a 2018 mixed media work by Jacolby Satterwhite. It was part of an entire booth of Satterwhite works sold at Art Basel by the Los Angeles gallery Morán Morán. Credit Courtesy of the Artist and Morán Morán

The Los Angeles gallery Morán Morán, also showing in “Statements,” sold its entire booth of recent works by the New York artist Jacolby Satterwhite. Featuring a mixed-media installation, videos, a virtual-reality piece and wallpaper, this sold to an Israeli collector for just under $100,000, according to the gallery. Another unique installation piece sold for $25,000. Mr. Satterwhite, who uses his mother’s drawings of unrealized inventions as a starting point, was one of the few artists represented at the fair whose practice explored digital media, including virtual reality.

But it was, perhaps, a sign of these conservative collecting times that sales in the “Statements” section were generally slow, despite its being hailed in a tweet by the influential Belgian collector Alain Servais as “challenging, experimental & significant,” as well as “relatively cheap.”

“Everyone is doing the same thing, with more or less success,” said Sebastien Montabonel, a London-based art consultant who specializes in advising institutions, referring to the proliferation of Mitchells, Condos, Longos and Kapoors on offer downstairs. “They’re showing what the bank manager wants to buy,” he added.

But curators, as well as bank managers, are shaping the art market.

“We’re looking at the idea of global modernism, at multiple art histories,” said Ms. Chiu of the Hirshhorn, whose museum, in common with many others, is rehabilitating the contribution of overlooked or marginalized artists.

Last month, the auction market caught up with the museum world when African-American painters set several new auction highs. Among them was the $2.2 million given for a 1974 portrait by Barkley L. Hendricks, who featured in last year’s influential “Soul of a Nation” show at Tate Modern in London.

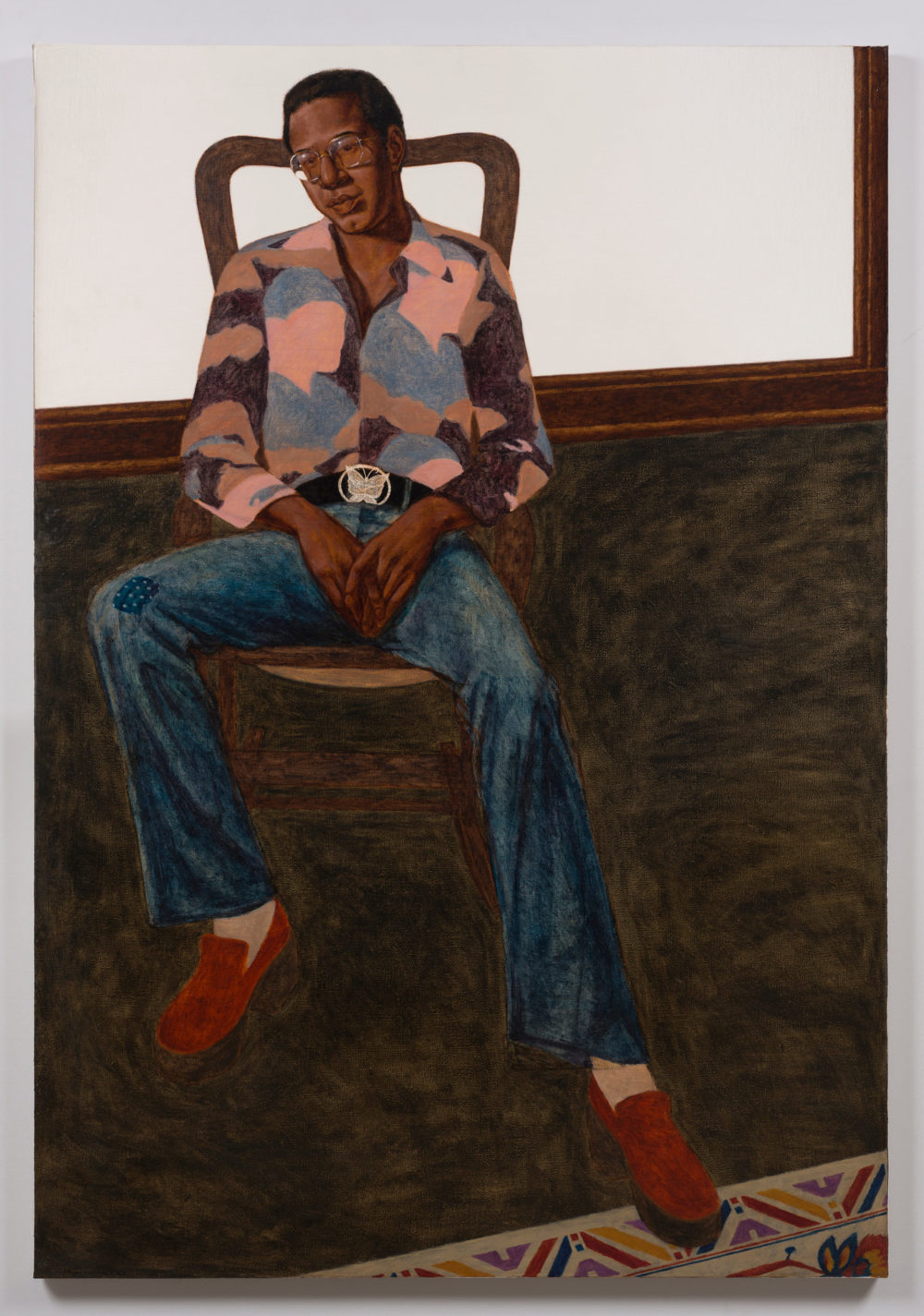

The New York dealer Jack Shainman sold the 1975 Barkley L. Hendricks painting “Greg” at Art Basel for $1.75 million. Credit Courtesy of the Artist andJack Shainman

That momentum was maintained at Art Basel. Jack Shainman, who represents the Hendricks estate, sold the artist’s imposing full-length portrait “Greg” to an American collector for $1.75 million.

The May auctions saw a new benchmark of $200,000 achieved for the African-American abstract painter Stanley Whitney. Here in Switzerland, the London and New York dealership Lisson Gallery was able to sell a large-scale 1999 “Untitled” by Mr. Whitney, priced at $400,000. But dealers were unwilling to quote prices for their sales of works by Kerry James Marshall, whose 1997 tour-de-force “Past Times” made a sensational $21.1 million last month at Sotheby’s.

Cathy Wilkes’s “Untitled,” a 2017 egg tempera on cotton painting, was sold at Art Basel by the Brussels dealer Xavier Hufkens for about $160,000. Credit Xavier Hufkens

And then there is the momentum given to artists by inclusion in prestigious exhibitions. The Glasgow-based artist Cathy Wilkes has been selected to represent Britain in next year’s Venice Biennale, following a well-reviewed show last year at MoMA PS1 in New York. The Brussels dealer Xavier Hufkens was able to sell an ethereal 8-foot-wide landscape painting by the artist for 120,000 pounds plus VAT, or about $160,000. Wilkes’s current auction high is $23,000.

It was perhaps inevitable that this year’s Art Basel would have a safer, more conservative feel. The fair and its sister events in Hong Kong and Miami are owned by the Basel-based MCH Group, whose main source of revenue is Baselworld, the world’s largest trade show devoted to watches and jewelry.

Exhibitor numbers at the March edition of Baselworld were down 50 percent, making the group more reliant on its art fairs as an income stream. Rather than dismantle Baselworld, MCH moved Art Basel’s “Unlimited” section of large-scale projects into a less lofty upstairs space. Art Basel’s public commission for the plaza in front of the fair, featuring a machine digger moving gravel from one pile to another, thus became an apt metaphor for MCH’s new situation.

“The art market is commercial, but that’s O.K.,” said Andre Gordts, a Belgian collector, browsing the booths of younger galleries on the first floor of the fair. “Sometimes you need to look back at the blue-chip to remind yourself what it’s all about. Contemporary art is quite chaotic at the moment,” he added. “But then the world is quite difficult at the moment.”